Advance Ruling

September 18, 2024

Advance Ruling is Trade Facilitation as per WTO agreement

Importers and Exporters who have ambiguity about their goods Classification, Duty structure and Valuation method can go for Advance Ruling. Advance Ruling will ensure tariff classification, exemption or concession in duties as per applicable customs notification. Also method of valuation of goods, and any other matters the applicant feels necessary for future import and export.

Definitions and scope: An advance ruling is a written decision provided by an Authority for Advance Ruling to an applicant before the importation or exportation of goods covered by the application that sets forth the treatment that the Customs Authority shall provide to the goods at the time of importation and/or exportation about (i) Tariff classification of goods and (ii) the origin of the goods.

In addition to the above Customs will also provide Advance Ruling on

a) Determine appropriate method and criteria for Customs Valuation.

b) Applicability of relief or exemption from Customs Duties as per Customs Notification.

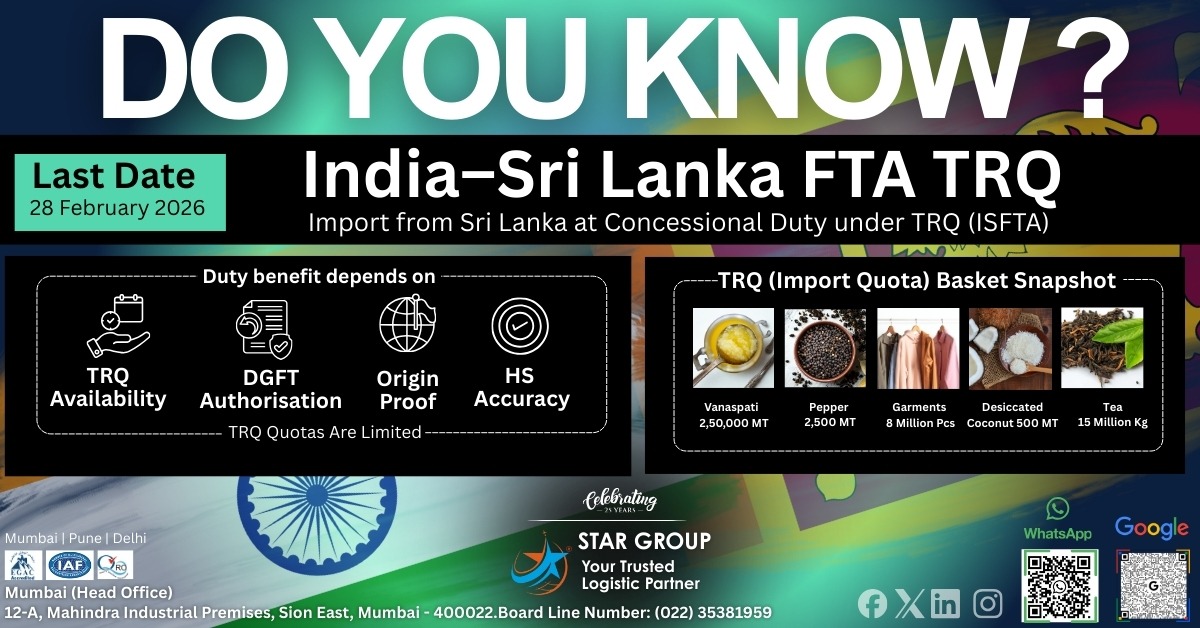

c) Requirement of Quota including Tariff Quota.

d) Any additional matter the applicant may feel necessary in which Customs Authority considers appropriate to issue

Advance Ruling.

Objectives for setting up Advance Ruling Authority and its benefits

(a) To provide certainty in Duty liability under the Customs in advance about an activity proposed to be undertaken

by the applicant.

(b) To attract Foreign Direct Investment (FDI).

(c) To reduce litigation.

(d) To pronounce ruling in a transparent and inexpensive manner.

(e) Certainty about liabilities of duty for foreign investor or Indian company setting up a mew project.

Validity: Advance Ruling is valid for three years from it is pronounced or till a change in law or facts based on which it has been

pronounced whichever is early.

Please note the issue, on which Advance Rulings is sought, should be in proper question form.

CBIC notified Customs Advance Ruling Authority as follows:

1. Customs Authority for Advance Rulings (CAAR), Delhi. Email id cus-advrulings.del.gov.in

Jurisdiction: North zone and East zone of India.

2. Customs Authority for Advance Rulings (CAAR), Mumbai. Email id cus-advruling.mum.gov.in

Jurisdiction: West zone and South zone of India.